Why Scholarships Are Vital for Low-Income Students and Families

For students from low-income families, college can be a massive catch-22: higher education has never been more important, but it’s also never been more expensive.

Filed In

- Advocating for Students

Topics

- Affordability

For students from low-income families, college can be a massive catch-22: higher education has never been more important, but it’s also never been more expensive. If college were accessible and affordable, students with high financial need would have a better chance to break the cycle of generational poverty; instead, the struggle to pay for higher education can leave them in dire financial straits.

At Scholarship America, our mission is to eliminate barriers to higher education, and to ensure those with the most need have the opportunity to thrive through equitable pathways to education and training. Private-sector scholarships can make a huge difference when it comes to filling the affordability gap for low-income students. Here’s how, and why, that effort is so crucial.

Higher education is the best ticket out of poverty.

Despite the cost, despite student struggles, despite the difficulty, one thing remains true: the more education you get beyond high school, the better your prospects are.

The numbers are stark. Georgetown University’s Center for Education and the Workforce reports: “Bachelor’s degree holders earn a median of $2.8 million during their career, 75% more than if they had only a high school diploma.” In other words, a bachelor’s degree makes a million-dollar difference. (A postgrad degree is still more; even an associate’s degree makes an impact in earning power.)

The benefits of higher education extend beyond the balance sheet as well. Nearly 90 percent of employed, college-educated millennials see their current job as part of a career path, while more than 40 percent of high-school-only millennials consider it “just a job.” Those with higher education report better health; they volunteer and vote more; they have longer life expectancy. In short, education makes lives better.

There’s a gap between cost and aid.

Unfortunately, too many of the students who could most benefit from higher education are finding it harder and harder to afford.

The National College Attainment Network (NCAN) released a landmark study in 2018 seeking to answer a simple question: can low-income students afford college? The study, entitled “Shutting Low-Income Students Out of Public Four-Year Higher Education,” assessed more than 500 four-year residential public colleges across the United States. These schools are traditionally the backbone of American higher education; they are the flagship, land-grant, research-oriented universities that people from all walks of life have long aspired to attend.

And they’re being priced out of reach.

According to NCAN’s research, when considering “the affordability of four-year public institutions for an average Pell Grant recipient who receives the average amount of grant aid, takes out the average amount of federal loans, and collects reasonable work wages … an astounding 75 percent of residential four-year institutions – including 90 percent of flagships – failed NCAN’s affordability test.”

Students, especially those whose family income qualifies them for Pell Grant aid, are increasingly unable to afford the benefits of a bachelor’s degree without going into debt—and that debt impacts them disproportionately. Seven in 10 graduates with federal loan debt also received a Pell grant, and Pell graduates have about $4,500 more in debt than higher-income students when they finish their degrees.

Scholarships can help fill that gap.

The NCAN model takes into account every avenue of public-sector assistance available to most students. It also reflects the reality that virtually all students work while in college. It states, clearly, that those sources of aid aren’t currently enough, especially for low-income, Pell Grant-eligible students.

Something besides student loans needs to fill the gap, and private scholarships are uniquely positioned to do so.

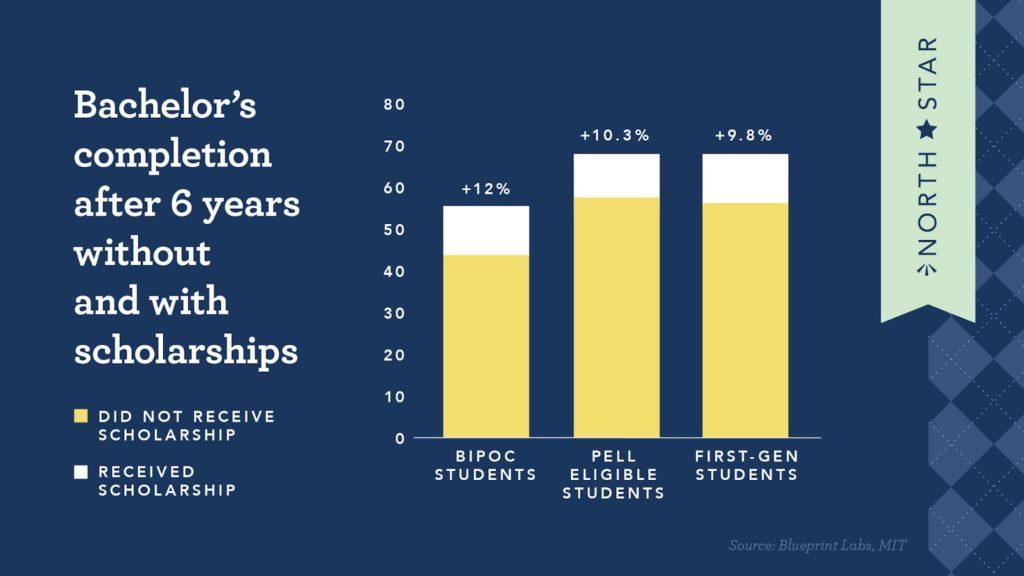

Scholarship America’s assessment of current research shows us that Pell-eligible, first-generation and BIPOC students who receive scholarships see their chances of graduating go up by 10-12% compared to their peers who don’t. That’s the largest boost of any population.

In California, a ten-year longitudinal study of the College Futures program, providing scholarships for students from low-income communities, showed similar results: “Approximately 95% of the California State University freshmen who received [College Futures] scholarships … returned for a second year of study, while only 82% of CSU freshmen from the same class statewide returned.”

However, the scholarship industry needs to evolve.

Though scholarships can boost graduation rates and reduce debt for students from low-income families, the scholarship industry isn’t doing enough to connect those students with the dollars they need.

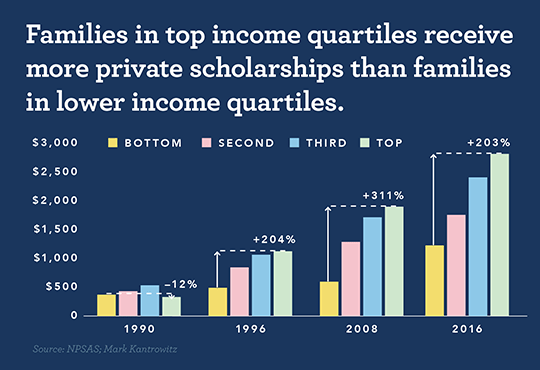

Research from the National Postsecondary Student Aid Study and financial aid expert Mark Kantrowitz indicates that families from the top income quartile receive, on average, more than double the private scholarship aid than families in the lowest quartile—a gap that has only grown larger over the last three decades.

What’s more, since Black, Hispanic and Indigenous students are much more likely than their white peers to be Pell-eligible, this inequitable distribution of scholarships can actually exacerbate the inequity of higher education financing.

But it doesn’t have to be that way—private scholarships, when thoughtfully managed, can be a huge part of the solution. The Gates Millennium Scholarship has helped more than 20,000 students of color since 1999, and the Jackie Robinson Foundation has provided assistance for more than 40 years. The Dell Scholars program, created by the Michael and Susan Dell Foundation, provides a unique form of wraparound support to low-income students who are often the first in their families to go to college. Since 2004, its combination of financial, social and mentoring support has helped more than 5,000 Dell Scholars, who “are 25 percent more likely to earn their bachelor’s degrees within four to six years of high school graduation compared to students of similar socioeconomic backgrounds.”

Whether scholarships are coming from a student’s school, a private-sector provider or a local foundation, they are a vital way for learners from low-income backgrounds to afford higher education. That education is a potential ticket out of poverty for those who complete their degrees—and that means scholarships matter now more than ever.

Related Articles

Browse All

Student Scholarship Survey Highlights College Affordability Crisis

Food, Housing Insecurity Leads to Mental Health Struggles, Affecting College Plans

Our team is here to help you achieve your goals and build your custom scholarship program.