Wait, What? Scholarships Are Taxable?

Everyone knows what a scholarship is. It’s free, no-strings-attached money to help a student pay for their higher education. Right? Usually. But not always.

Filed In

- Advocating for Students

- Navigating Financial Aid

Topics

- scholarship taxability

- Taxes

Updated February 2024

Everyone knows what a scholarship is. It’s free, no-strings-attached money to help a student pay for their higher education.

Right?

Usually. But not always.

In some cases, there are significant strings attached—including a few situations in which scholarship funds may be treated as taxable income. While it’s unusual, it’s also important for both students and scholarship providers to know how this can happen, and how it can be avoided.

A (Very) Brief History of The Tax Treatment of Scholarships

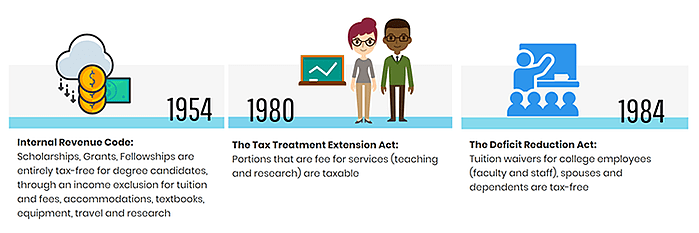

The tax status of scholarships was first codified in 1954, and until 1980 it was exceedingly simple: for students pursuing a degree, all scholarships, fellowships and grants were tax-free, no matter what the funding was used for.

The first major change to this system came in 1980, when the Tax Treatment Extension Act was passed. This amendment to the tax code specified that scholarships, grants or fellowships could be taxed if they could be considered “fees for services.” In IRS terms, that means “[money] received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant.” Exceptions were later added for teaching and research assistantships and for certain federal student aid programs, but this represented the first time any income related to scholarships was regarded as taxable.

The 1986 Tax Reform Act added significantly more potential taxation to scholarship and grant funds. For the first time, the new law specified that portions of scholarship aid used for living, travel or research expenses would be treated as taxable income. While later amendments eased some of the tax burden (especially for graduate student teachers), this law remains on the books today—meaning that stipends or cash payments received for non-tuition expenses will be considered taxable. (These payments should be accompanied by a 1099 tax form, making it easier to include them in your taxable income calculations.)

Finally, current law also states that scholarships for non-degree-candidates are taxable. As professional certifications and certificate programs become more popular—and even vital, to industries like software development and engineering—those laws put more and more nontraditional students at risk of a heavy tax burden from scholarships.

The Hidden Cost of Taxing Scholarships

As outlined by financial aid expert Mark Kantrowitz in this whitepaper for the National Scholarship Providers Association (NSPA), “There are several harmful consequences of the government taxation of scholarships, grants and fellowships.The harmful impact affects the ability of students to complete their education and graduate.Taxing financial aid prevents students from making full use of their scholarships, fellowships and grants.Scholarships, fellowships and grants are the only form of generosity that is taxed by the federal government.”

Those consequences are most stark for the student: when more of their scholarship funds go to taxes, they have less available to pay for their education. Making matters worse, most federal financial aid calculations are based on the pre-tax value of the scholarship, meaning they risk a shortfall in aid when they can least afford it.

There are also powerful drawbacks for scholarship providers. As Kantrowitz says, “Private scholarship providers are reluctant to create new scholarship and fellowship programs and to expand existing programs because taxation makes the programs less effective than other charitable purposes.” In addition, while innovative scholarship funders may want to help students with the onerous costs of rent, board and transportation, the taxable nature of these funds blunts their impact.

The impact is especially disproportionate on low-income students. Those from the bottom income quartile spend, by far, the largest percentage of family income on higher education; almost half of that money is spent on the non-tuition costs for which scholarship awards are taxable. (Under current law, emergency financial grants could also be considered taxable income—and those grants are most vital for low-income students.)

Those attempting to save money by attending two-year colleges are also likely to be hit hard. According to The College Board, living expenses for students at community colleges can make up more than 70 percent of the cost to attend. Taxing scholarships that are used for those expenses adds a huge burden to those who can least afford it, even if they’re attending school on a full-ride scholarship or in a tuition-free state.

Restoring Scholarships’ Tax-Free Status

While taxing scholarship funds may increase government revenue in the short term, it is also short-sighted. As Kantrowitz explains, “Scholarships, grants and fellowships help students graduate from college. The federal government benefits financially from the increased federal income tax revenue attributable to higher educational attainment. So, it is in the federal government’s best financial interest to stop displacing scholarships, grants and fellowships through taxation.”

Scholarship America and analyst Mark Kantrowitz have made these four recommendations for doing so:

- Clarify that tax-free status applies to students pursuing a certificate, not just a degree

- Clarify that tax-free status applies to grants, scholarships, fellowships and tuition waivers, as well as teaching assistantships and research assistantships

- Replace the definition of “qualified tuition and related expenses” with a definition of “qualified higher education expenses,” defined in relation to total cost of attendance

- Limit tax-free status to regular students enrolled at postsecondary institutions that are eligible for Title IV federal student aid

These four steps will ensure that new forms of certification and new models of payment aren’t punished for being “nontraditional.” They will also ensure qualified scholarships are available to pay for the full cost of education at eligible colleges and universities—and that will allow scholarships to be used, tax-free, to pay for room and board, transportation to and from college, and disability- and other college-related expenses.

As we work toward this goal, it’s important for all education stakeholders to clarify the current situation, and to support financial aid innovation and student support.

This post is based on research originally presented at the National Scholarship Providers’ Association Conference by Mark Kantrowitz of SavingForCollege.com and Despina Costopolous Emerson of Scholarship America. This post was updated Feb. 19, 2024 to reflect new statistics about living expenses.

Related Articles

Browse All

Infographic: Taxability of Scholarships

Scholarship America Program Q&A: Chevron Phillips Chemical Dependent Scholarship Program

Our team is here to help you achieve your goals and build your custom scholarship program.