Understanding College Financial Aid: Scholarships

Learn how scholarships fit into your financial aid package and important information as to how scholarship money impacts the cost of college.

Filed In

- Paying for College

- Resources

Topics

- Financial Aid

- How to Pay for College

- Scholarships

Scholarship America believes in the vital importance of scholarships as part of your financial aid package. Students from all walks of life and with all kinds of skills can earn scholarships, and they can go a long way toward making financial aid less stressful. But even the free money that comes from scholarships can have some unintended consequences. Here’s how to make sure you’re getting the most out of your hard-earned awards!

Financial Aid Displacement

This might surprise you, but not all colleges treat your scholarship dollars the same way. Some colleges will reduce the amount of need-based grant aid, loans, and/or work-study if you get a scholarship. Think this is unfair? Us too. But it’s a fact of life for some students.

After you submit your FAFSA, colleges will send you a Financial Aid Letter (or Financial Aid Offer) and determine your “unmet need”, which is money that you and your family have to cover in addition to your Expected Family Contribution (EFC). Scholarships can help reduce unmet need or eliminate it all together depending on the total amount you receive—but only if your college of choice will apply the money that way.

Unfortunately, some schools use “financial aid displacement,” a practice in which students’ financial aid awards are reduced when they add private scholarships to their family contribution. Follow these three tips to ensure your scholarships receive fair treatment.

1. Research the college’s outside scholarship policy

“Outside” scholarships, also called “external” or “private” scholarships, are those scholarships you receive from sources other than the college. Your outside scholarship may include community-based scholarships (like Dollars for Scholars, a program of Scholarship America, or those from the Rotary, Elks, your high school foundation, or your church); scholarships from your parents’ employers; or scholarships you earn as a result of a larger regional or national competition.

Look for schools that apply scholarships to the unmet need portion of your financial package, rather than those that will reduce the amount of institutional grant aid.

Some colleges share their policy toward outside scholarships right on their websites. Make sure you search the college websites for both “outside scholarship policy” and “external scholarship policy,” as they may go by either name. For those colleges that don’t list their policy, you will need to ask your college financial aid officer. Look for schools that apply scholarships to the unmet need portion of your financial package, rather than those that will reduce the amount of institutional grant aid.

2. Talk with your financial aid officer

See if your college financial aid officer will first apply your outside scholarship(s) to your unmet need, and if there are dollars remaining, use the scholarships to reduce your loans. Some schools may also adjust the cost of attendance to include the cost of a computer, art supplies, or other expensive gear to help you keep the full amount of your outside scholarship. It’s always worth it to ask.

3. Ask your scholarship sponsor to defer all or part of your scholarship

If you’ve hustled to find every scholarship you can, there’s a possibility that you’ll end up with an “overaward”—more financial aid than you need to cover your tuition and fees for the year. It’s uncommon, but it can result in losing the “extra” part of your funds. In this case, you should reach out to the organization that provided the scholarship and request to defer all or part of it to a future academic year. (Typically, overawards happen to freshmen who earned a lot of scholarships in high school. If this is you, you’ll be happy to have the extra money coming in your sophomore year!)

All of this might have you considering keeping your scholarships a secret from your college, but that could be even more costly. Federal law requires students to disclose all scholarships when federal financial aid plays a role in your aid package. If you don’t report your outside scholarships, you may be required to repay the school or the federal government all or part of your need-based financial aid package.

Scholarships as taxable income

Displacement isn’t the only way you can lose a portion of your scholarship. While it’s not common, there are a few situations in which scholarship funds may be treated as taxable income.

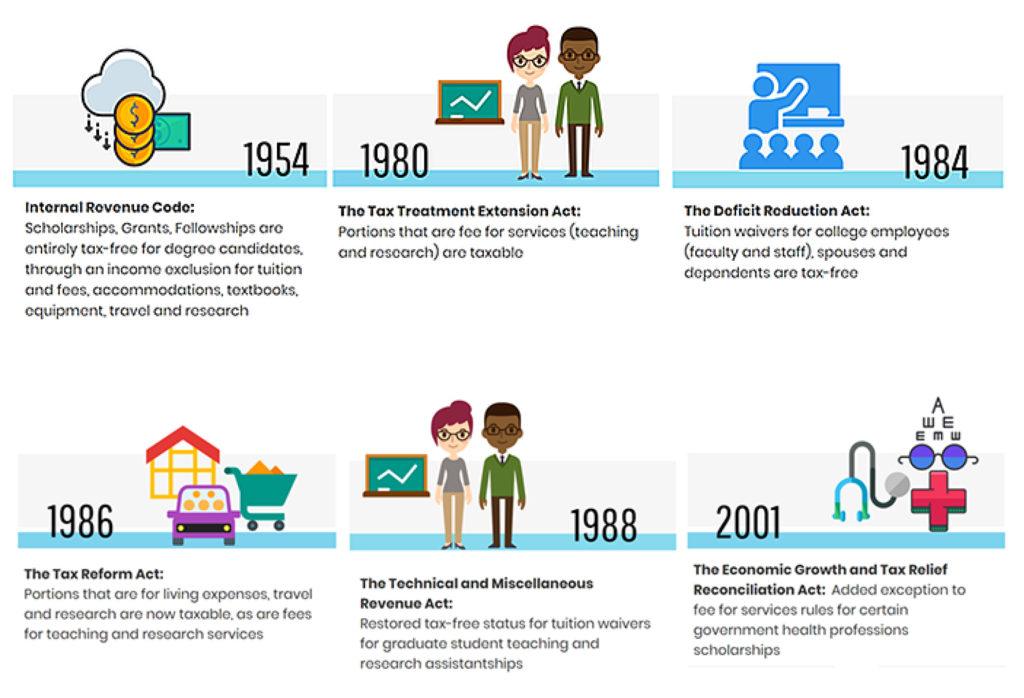

Until 1980, all scholarships, grants and fellowships were tax-free, no matter what they were used for. However, changes in laws since then have divided scholarship funds into two broad categories. Those that are used on costs such as tuition, fees, books and supplies are tax-free. But scholarships and grants that apply toward other mandatory college living expenses including housing, food, transportation, and childcare, are taxable.

But wait, aren’t living expenses a big part of college expenses?

Yes, as we know, housing expenses alone are a large and growing part of the cost to attend college. According to The College Board, 2017-18 undergraduate living expenses make up over half of all college expenses. And for students attending 2-year colleges, living expenses make up more than 70 percent of the cost to attend. This means even if you’re attending college “for free,” you might owe more than you think.

Will I be taxed on my scholarships and grants?

Every case is different, but here are some of the most likely students to face taxes on their scholarship aid.

-

- Students who receive a “full-ride” scholarship could have a tax liability because the portion of the scholarship used for college living expenses is currently taxable.

-

- Students who work throughout the year will probably earn enough to surpass the tax filing threshold. The average annual work earnings of an enrolled undergraduate student working a 29-hour work week were $16,000 – this is well above the income threshold above which a tax return must be filed.

-

- Students who receive emergency financial aid or other mixed federal, state or institutional grants could also be impacted and pay tax on the portions of those funds used for college living expenses.

-

- Graduate students, who often work more, or students pursuing fellowships or professional degrees could face tax liability on their scholarships and paid fellowships.

Scholarship America and other organizations are working hard to limit the tax burden on scholarship recipients. However, for now, it’s important to know that some of your scholarship or grant funds may be taxable. Your financial aid advisors want you to make the most of your awards—if you’re running into any of the situations above, we recommend working with them to figure out the best way to reduce your tax liability and make the most of your scholarship!