Understanding College Financial Aid: The FAFSA

Financial aid for college is confusing. We’re here to help you understand financial aid starting with the first step in the process: the Free Application for Federal Student Aid or FAFSA.

Filed In

- Paying for College

- Resources

Topics

- FAFSA

- Financial Aid

- How to Pay for College

For students looking for financial support to attend school, filling out the Free Application for Federal Student Aid—the FAFSA—is the first place to start.

Like the name says, the FAFSA is entirely free, and it determines what kind of aid you may be able to get from the federal government. But it does much more than that: states use your FAFSA data to determine if you’re eligible for statewide aid, and almost every college looks at your FAFSA to figure out their financial aid offers to you as well. It’s the single most important piece of the process. Here are the five things you need to know before you start.

1. When can I start my FAFSA?

The FAFSA is available to students every year starting October 1, and you should try and get as early a start as possible. Thanks to recent simplifications, the FAFSA now connects directly to the IRS, and can pull in your family’s tax data from the previous year.

2. What is the deadline for submitting my FAFSA?

Remember, you need to fill out the FAFSA every year, not just your senior year of high school.

The Federal FAFSA deadlines are a little deceiving. While you can technically fill out the application anytime between October 1 and June 30, waiting that long would be a big mistake. Most states and schools have earlier deadlines, with February and March typically being important months in a lot of places. In lots of cases, state and school funds are first-come, first-served, so it’s always in your best interest to fill out your FAFSA as soon after October 1 as you can.

Check the list of state deadlines for the FAFSA on the Federal Student Aid government website. When it comes to your school’s specific deadlines, add a calendar reminder in mid-August to double-check about deadlines, and find out if you can take advantage of any early FAFSA opportunities. While many institutions will still accept your FAFSA submission past their initial deadline, applications submitted before then take precedence and will receive earlier award letters.

Remember, you need to fill out the FAFSA every year, not just your senior year of high school.

Finally, the number one mistake with the FAFSA is not filling it out, so regardless of where you are in the process it’s always worth it to complete.

3. Am I a dependent or not?

Many students get tripped up on whether they classify as an independent or dependent. This can get especially tricky for upperclassmen who may not live with their parents or legal guardians, but still qualify as a dependent. Remember: just because parents opt not to help pay for school does not grant someone independent status. Download this questionnaire from the FAFSA website to determine your dependency status.

While this may seem like a small question, your dependency status actually determines whose tax information needs to be provided. Dependent students who fail to provide their parent information risk having their forms rejected. This means no Expected Family Contribution (EFC) will be calculated—and most schools require an EFC in order to issue award letters, including merit-based scholarships (more on EFCs later). Miss this step, and you may severely restrict your options.

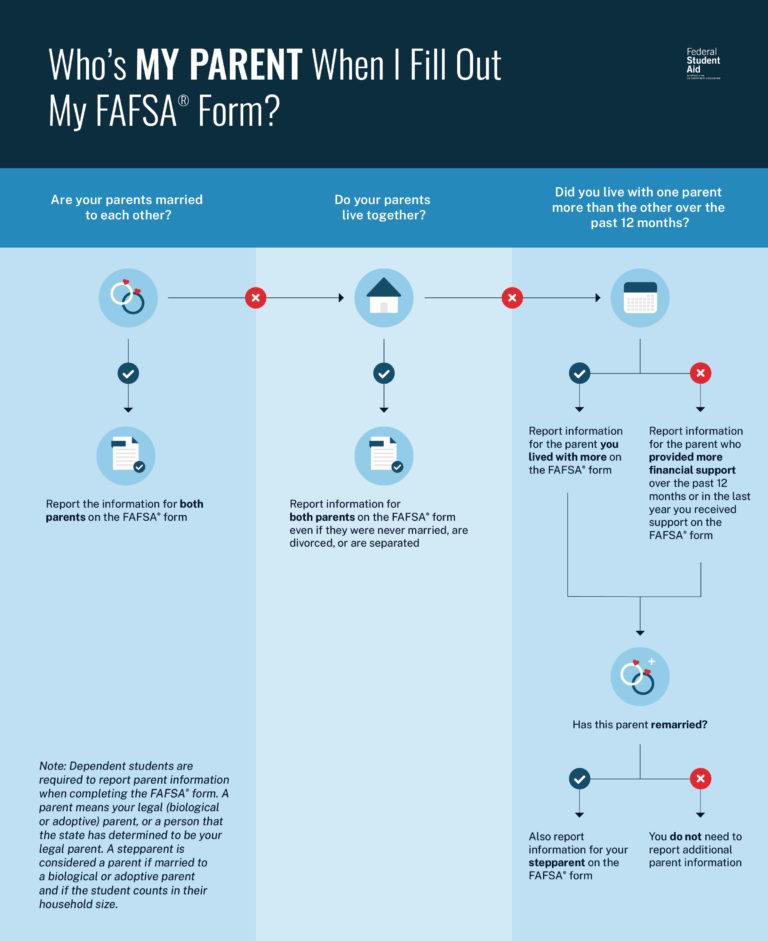

4. Who are my parents, anyway?

This may seem like a crazy question, but it’s actually the part of the FAFSA that gets the most confusing. Students whose parents have separated or who have been placed in legal custody of another relative may wonder whose information they need to include. This is important to determine, as it affects whose information is included in the parent tax records that calculate the EFC.

Read the legal definitions of terms carefully as they will help clarify who should provide information. It is not as simple as just including the information of the people you live with. If you live in the custody of another person, you cannot use their information unless they have legally adopted you. To help you determine whose information should be included in the parent section of your FAFSA, check out this handy flowchart:

5. What is work-study?

Work-study is a special type of part-time job provided by your college where you can earn money toward your education expenses. When filling out the FAFSA, you can indicate whether you’re interested in a work-study job. A lot of first-time FAFSA filers assume that indicating interest in work-study means you must take a work-study job. That’s not true – and misreading can mean missing out.

If you are awarded potential work-study dollars, you can choose whether or not to commit to a work-study program. However, if your FAFSA says you are not interested in work-study, you will not be eligible for any work-study programs or dollars whatsoever during that year. Unless you’re certain of your work situation, don’t miss out on potentially valuable dollars and opportunities by saying “no” on the FAFSA.